Bitcoin soon to return to $ 40 000 ?

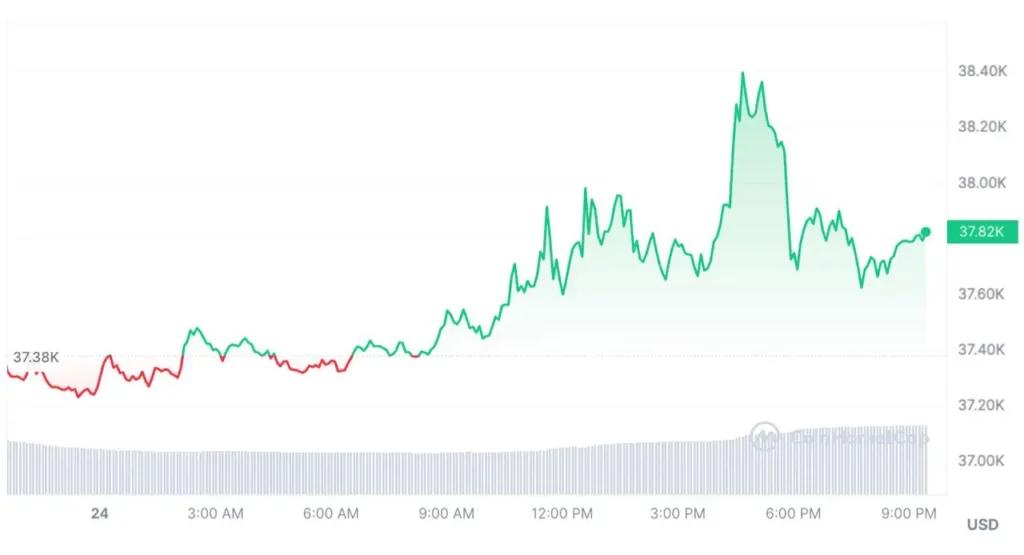

On this Friday, November 24, 2023, the price of BTC surpassed $38 000, showing an increase of 1.86% over the past 24 hours. Can Bitcoin reach $40 000 before the end of 2023?

In our technical analysis, we observed a significant test and retest of the lower Bollinger bands on the 4-hour and 1-day charts of Bitcoin, which revealed a successful rebound. This rebound indicates resilience and a possible bullish trend for BTC.

Bollinger Bands are used by traders to measure volatility and overbought or oversold levels.

On this chart, we notice that despite similar price levels, there have been significant variations in traders’ behavior. Last week, we observed substantial trading volumes with high leverage and high funding rates. Whereas this week, there has been a reduction in leveraged trading levels and lower funding rates.

This could indicate that investors are opting for spot trading strategies in anticipation of a BTC price increase.

Another phenomenon to consider is the clearing of large leverages in the market, which explains the multiple tests of the Bollinger Bands. This cleansing is often seen as a necessary step to eliminate excessive speculation and prepare the ground for a market rise.

In light of recent news, especially regarding the resignation of Changpeng Zhao (CZ), which could have negatively influenced investor sentiment towards cryptocurrencies, Bitcoin and the overall cryptocurrency market have ultimately managed to overcome the FUD related to Binance.

Additionally, the SEC appears to be moving towards approving Bitcoin spot ETFs in the coming days. This is a positive sign for the crypto market.

Another factor is Tether’s announcement of its intention to reveal its documents to the public, a move it previously refused and which had generated FUD around USDT. This transparency will strengthen confidence in stablecoins and, by extension, in the entire crypto market.

Prediction : Will the price of Bitcoin (BTC) reach $40 000 and beyond ?

At the time of writing, Bitcoin is around $37,696 with a neutral funding rate and a lower futures trading volume compared to last week.

This trend indicates that the majority of purchases are being made in spot rather than on leverage. This could probably mean that investors’ sentiment towards Bitcoin is positive, and they expect BTC’s price to continue to rise.

If we stick to our technical analysis and the latest factors around the cryptocurrency market, Bitcoin is likely to reach the $40 000 mark in the coming days.

However, it’s interesting to note that we have not yet reached the phase of excessive speculation linked to the misuse of leverage. This ‘leverage frenzy’ is often accompanied by strong price fluctuations. The fact that we have not yet experienced this indicates a relatively cautious approach by investors towards Bitcoin.

The cautiousness of crypto investors could suggest that the recent BTC price increase is just the beginning of a bullish rally. It is possible that the Bitcoin price will continue to rise, possibly reaching $42,000 before undergoing a correction, and then retesting the $38,500 level.