Bitcoin ETFs Could Be Approved by January 10, 2024

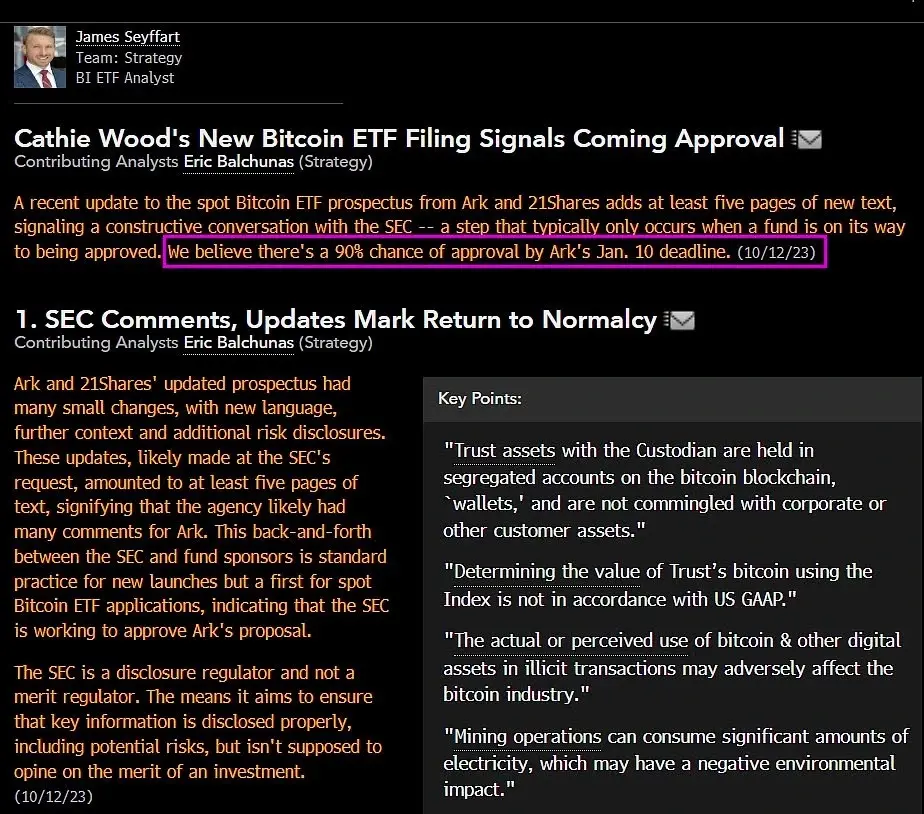

Bloomberg’s ETF analyst, Eric Balchunas, confirmed on X (formerly Twitter) that the Bitcoin ETF has a 90% chance of being approved by the SEC by January 10.

On November 28, James Seyffart revealed that the SEC had delayed its decision on ETF applications, including those from Franklin Templeton and Hashdex, 34 days ahead of the January 1, 2024 deadline. Seyffart and Balchunas then estimated a 90% likelihood of approval for spot Bitcoin ETFs by January 10, 2024.

“This delay for Hashdex confirms that it’s a decision to align all applications for a potential approval by the latest January 10, 2024.”

The SEC has specifically delayed the spot Bitcoin ETF applications from Franklin Templeton and Hashdex Bitcoin futures for a particular reason : the agency decided to seek the American public’s opinion on these proposals.

This step is a key element in the ETF approval process. It allows the SEC to gather external feedback on critical aspects such as the potential for market manipulation and the reliability of the exchanges where these ETFs would be traded.

For Franklin Templeton and Hashdex, the SEC has asked the public to specifically comment on the Form 19b-4s, regulatory documents detailing how these ETFs would operate and be regulated.

Towards Simultaneous Approval of All Bitcoin ETFs ?

According to Bloomberg analysts James Seyffart and Eric Balchunas, the SEC is considering approving all Bitcoin ETF applications at once.

If this collective ETF approval occurs, it would mark a major turning point for the cryptocurrency market.

The crypto community eagerly anticipates the SEC’s actions in the coming weeks. In the event of ETF approval, Bitcoin and other cryptocurrencies could experience a significant increase. At least, that’s what many crypto investors are hoping for…