Bitcoin on the rise ! how far can this new bull run take us ?

Last night, Bitcoin crossed the $40,000 mark, marking a +6% increase in just a few hours. Later this morning, the BTC price reached $42,000, and it is currently hovering around $41,500.

This surge in Bitcoin has led to price increases in other major cryptocurrencies such as Ethereum (ETH), Ripple (XRP), and Binance Coin (BNB) during the same period.

The reasons behind BTC’s rise

This upward momentum in Bitcoin can be attributed to various factors, including recent news of a possible approval of Bitcoin Spot ETFs. If the ETFs are approved by the SEC, it could have a significant impact on the cryptocurrency markets, potentially leading to an increase in the value of Bitcoin.

Furthermore, the upcoming Bitcoin halving scheduled for April 2024 is a major event. Previous halvings have demonstrated their ability to positively impact the price of Bitcoin. This programmed reduction in mining rewards intensifies the interest of cryptocurrency investors in Bitcoin, anticipating an increase due to the scarcity of supply.

Additionally, the monetary policy of the United States could influence the crypto market and Bitcoin. During periods of low interest rates, Bitcoin becomes an alternative asset for investors seeking higher returns.

Moreover, current geopolitical tensions have heightened interest in Bitcoin, which is considered a safe haven in times of uncertainty. It provides protection against traditional market fluctuations and plays an increasingly significant role in diversifying investment portfolios.

As evidence, the increase in addresses accumulating bitcoins is a testament to renewed confidence in Bitcoin. Despite its volatility, BTC is increasingly perceived as a strategic investment and a long-term store of value by participants in the cryptocurrency market.

Will the price of Bitcoin (BTC) rise or should we prepare for a fall ?

The year 2023 has been generally positive for Bitcoin, and the question on everyone’s mind is : Will Bitcoin return to its all-time high (ATH) in 2024 ?

However, it is important to note that BTC is still far from its historical ATH, which was approximately $70,000. Nevertheless, current trends and upcoming key events such as the next halving could keep BTC on an upward trajectory.

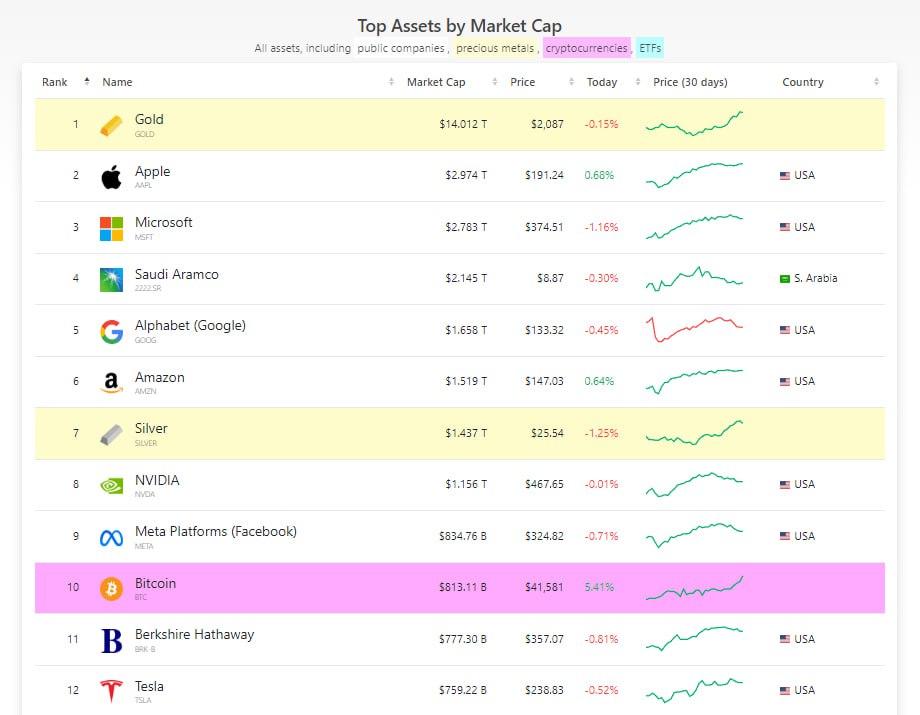

Bitcoin has recently achieved an impressive feat : it has entered the top 10 most valued assets in the world, with a total value of $813 billion. This performance places Bitcoin ahead of well-known companies like Berkshire Hathaway and Tesla.

This demonstrates how important and recognized Bitcoin has become in the world of finance, attracting the attention and trust of an increasing number of investors.

Bitcoin investors must exercise caution and stay consistently informed. Each bullish cycle (bull run) comes with its share of risks, particularly in terms of liquidations. A potential rise of Bitcoin to $50,000 could be accompanied by short periods of sell-offs, especially in the current context where the bull run appears largely speculative.